Information & Communications Technologies (ICT)

Industry Size and Composition | Labor Force | Business Competitiveness | Innovation

The Greater Toronto Area Information and Communications Technologies (GTA ICT) Benchmarking Study conducted by E&B DATA compared the Toronto region with other top metropolitan regions in North America. The study concluded that the Toronto region’s ICT cluster is now one of the TOP THREE in North America.

The study findings illustrate the breath and depth of the GTA ICT industry in the three key sectors of Manufacturing, Software & Systems Development, and Services. Top sector employers and industry leaders such as Celestica, Xerox, Sony, IBM, CGI, Oracle, Rogers Communications, Bell Canada, Allstream, MDS and Hewlett-Packard Canada.

The GTA ICT Study was conducted in partnership with the Greater Toronto Marketing Alliance (GTMA) and the City of Toronto with support from Ontario’s Ministry of Economic Development and Trade (MEDT) and the Government of Canada’s Program for Export Market Development – Investment.

Industry Size and Composition

Third largest ICT cluster in North America

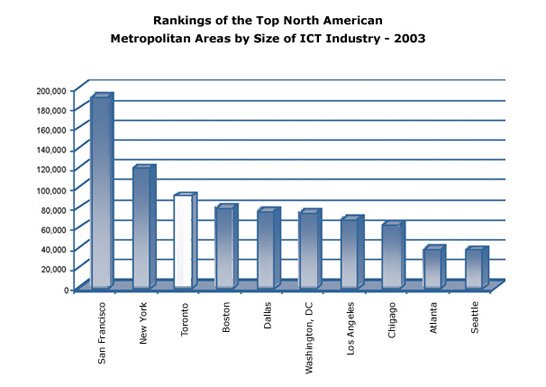

Employing more than 148,000 people in over 3,362 ICT facilities, the GTA’s ICT cluster rivals historical leaders such as San Francisco and New York, and is ahead of such technology centres as Boston and Washington D.C.

Source: E&B DATA, Greater Toronto Information & Communications Technologies Industry Profile; 2004.

Note: Private Facilities of 100+employees

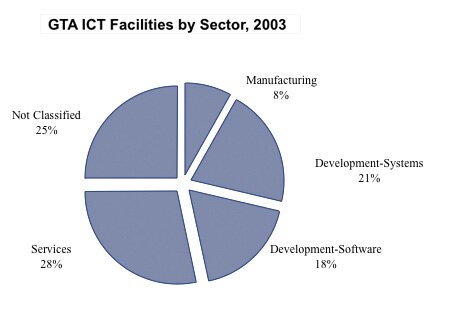

Top ICT employers in Manufacturing, Development and Services

Top sector employers and industry leaders include Celestica, Xerox, Sony, IBM, CGI, Oracle, Rogers Communications, Bell Canada, Allstream, MDS and Hewlett-Packard Canada.

GTA ICT Facilities

The spread of ICT activities in the GTA reflects sector concentration, with manufacturing facilities distributed primarily around the City of Toronto.

Development activities are located in the GTA according to their markets. For instance, facilities dedicated to financial or media applications tend to be concentrated within the City of Toronto, while facilities developing industrial automation applications tend to be found in the manufacturing areas of the GTA, outside of the City of Toronto.

Services are dispersed throughout the area, with several smaller services operations located across the region.

Source: E&B DATA, Greater Toronto Information & Communications Technologies Industry Profile; 2004.

To view the distribution of ICT facilities, click on the maps:

The GTA feeds the ICT sector’s growth with one of North America’s most diverse economies

52% of all GTA-based firms target:

- Financial services

- Business services

- Industrial markets

These firms are driving increased productivity and the creation of new business applications such as e-health, e-learning and e-banking.

24% target other ICT companies as customers, helping to drive industry growth and innovation.

24% target consumer markets in response to market demands and opportunities.

MARKET APPLICATIONS FOR ICT INDUSTRY IN THE GTA

Source: E&B DATA, Greater Toronto Information & Communications Technologies Industry Profile; 2004.

Investments:

In the last two years four major international companies invested over $300M into the GTA economy: Oracle, IBM, Microsoft and Siebel systems.

Satyam Computer Services

In early 2004 Satyam Computer Services opened a new R&D Centre in Mississauga. The company offers information technology services worldwide, including software development, consultation services, engineering design and systems integration. One hundred new jobs have been created.

Freescale Semiconductor

Former Motorola semiconductor business unit, Freescale Semiconductor, opened its Canadian head office in Markham. The company produces chips for the networking, industrial, automotive and wireless markets.

Globalmaxx Technologies

Globalmaxx Technologies relocated its operations to the City of Mississauga. Globalmaxx is one of North America’s leading integrated service providers delivering a combination of applications, hardware, services and consulting.

SAS Canada

SAS Canada is investing $30M in the construction of new headquarters office in the City of Toronto. The company manufactures and markets computer software.

Solcorp (EDS Corporation)

Solcorp has invested $1M in the relocation of its Canadian headquarters to the City of Toronto. Solcorp provides software solutions for the life insurance and wealth management industries.

Labor Force

Skilled human resources

The total ICT labor force in the GTA consists of 148,000 workers, 70% of which are concentrated in the Development and Services sectors.

| Sector |

Employment |

Percent of Employment |

| Manufacturing |

28,000 |

15% |

| Development - Systems |

26,000 |

18% |

| Development - Software |

22,000 |

15% |

| Services |

64,000 |

43% |

| No Classification |

8,000 |

5% |

| Total |

148,000 |

100% |

Source: E&B DATA, Greater Toronto Information & Communications Technologies Industry Profile; 2004.

In addition:

There are 40,000 ICT specialists in non-ICT sectors, with an estimated 6,500 to 7,000 R&D employees in dedicated ICT industry facilities.

Higher education institutions help prepare next generation of ICT workers

With a total enrolment of 225,000 students, Greater Toronto Area universities and colleges are an important resource for a skilled future workforce. ICT-related firms in the GTA also have access to graduates from a number of other highly regarded universities less than two hours from downtown Toronto, including the University of Guelph, the University of Waterloo, Wilfred Laurier University in Kitchener, the University of Western Ontario in London, and McMaster University in Hamilton.

Annual enrolment & graduates in Toronto Area Universities

| |

Enrolment (2002) |

Graduates (2001) |

Enrolment (2002) |

Graduates (2001) |

| Toronto |

1389 |

197 |

5,328 |

1,044 |

| Ryerson |

0 |

0 |

3,559 |

459 |

| York |

741 |

10 |

111 |

0 |

| UOIT (2003) |

120 |

0 |

211 |

0 |

| Guelph |

155 |

27 |

762 |

106 |

| Waterloo |

2351 |

402 |

5,100 |

838 |

| Wilfred Laurier |

84 |

15 |

0 |

0 |

| McMaster |

345 |

66 |

3,306 |

422 |

| Total |

5,185 |

717 |

18,377 |

2,869 |

*Note: Table excludes the 5th GTA University, Ontario College of Art and Design

Source: Ministry of Economic Development and Trade, 2003, University of Ontario Institute of Technology, 2003.

*Note: Over 2000 ICT students graduated in 2001 Source: Ontario Ministry of Education, Ministry of Training, Colleges and Universities.

In addition to the public education system, a variety of private schools offer ICT education. Seventy-six such private training schools have been identified in the GTA.

| University of Toronto |

23 |

| York University |

12 |

| Ryerson University |

8 |

| University of Ontario Institute of Technology |

1 |

| Total University-Level Programs |

44 |

| Centennial College |

7 |

| Durham College |

6 |

| George Brown College |

6 |

| Sheridan College |

6 |

| Humber College |

6 |

| Seneca College |

5 |

| Ontario College of Art & Design |

3 |

| Total College-Level Programs |

39 |

Source: E&B DATA, Greater Toronto Information & Communications Technologies Industry Profile; 2004.

Business Competitiveness

The Toronto Region is ranked as the #1 North American location in terms of low labor costs for ICT operations.

| Metropolitan Area |

Average Annual Pay $US |

| Toronto |

$50,850

|

| Atlanta |

$58,802

|

| Miami |

$59,101

|

| Dallas |

$59,364

|

| Houston |

$60,516

|

| Washington DC |

$62,174

|

| Philadelphia |

$62,878

|

| Chicago |

$63,484

|

| Seattle |

$64,682

|

| Boston |

$65,039

|

Source: E&B DATA, Greater Toronto Information & Communications Technologies Industry Profile; 2004.

Operating costs

Toronto region is more affordable than all of its U.S. counterparts, in particular when compared to other metro areas such as San Francisco (including Silicon Valley) and New York.

Source: KPMG, Competitive Alternatives, 2004.

Note: KPMG data was normalized, with Toronto as the baseline index of 100.0. Index calculation by E&B DATA

Innovation

Outstanding Private sector R&D

E&B DATA study (2004) has found that the Development sector has the highest research intensity in the GTA with 9% of the workforce allocated full-time to the development of new products and services. R&D in Services and Manufacturing represent 3% and 2% of employment respectively.

For example:

IBM Toronto Software Lab, with more than 2,000 employees is Canada’s largest software development facility. It develops leading products for worldwide distribution in the areas of application development tooling, application servers, database management software, electronic commerce applications, and systems management solutions.

| Rank among top Canadian corporate R&D spenders |

Company

|

| 1 |

Nortel Networks |

| 5 |

IBM Canada |

| 6 |

Bell Canada |

| 7 |

ATI Technologies |

| 26 |

Geac Computer Corporation |

| 36 |

Motorola Canada |

| 37 |

Hummingbird |

| 49 |

Open Text Corporation |

| 50 |

Leitch Technology Corporation |

| 60 |

Celestica |

| 63 |

Gennum Corporation |

| 68 |

Pivotal Corporation |

| 70 |

724 Solutions |

| 86 |

Financial Models Company |

| 88 |

CGI Group |

Source: Research Infosource Inc. 2003, interpreted by E&B DATA.

Intensive Public Sector Research & Development

Approximately 100 R&D centres have been identified within GTA universities, community colleges and other public institutions such as Bell University Laboratories.

| University of Toronto |

8 |

14 |

11 |

28 |

| Ryerson University |

1 |

2 |

3 |

15 |

| York University |

0 |

3 |

2 |

6 |

| Total centers in universities |

9 |

19 |

16 |

49 |

| Total centers in colleges |

2 |

3 |

3 |

5 |

| Total centers in GTA |

11 |

22 |

19 |

54 |

Source: E&B DATA, Greater Toronto Information & Communications Technologies Industry Profile; 2004.

Note: E&B DATA Compilation. R&D centers may have several areas of expertise (e.g. Digital Media and e-Health).

The University of Toronto has more than 50 ICT research centres, including the Knowledge/Intelligent Systems Laboratory, the Cognitive Robotics Group, the Computer Engineering Research Group, and the Laboratory Network for Innovation and Technology in Education (LNITE).

Ryerson University has more than 20 ICT research centres, including the Centre for Learning Technologies, the Advanced Radio-Optics Integrated Telecommunications Group and the Computer Systems and VLSI Group.

York University has more than 10 centres, including the Human Computer Interaction Lab, the Institute for Robotics & Intelligent Systems and the Laboratory for Industrial and Applied Mathematics.

Exemplary collaborations between industry and academic researchers

Bell University Laboratories (BUL) is a groundbreaking model of collaboration between academic research and commercial applications with the goal of enhancing commercially viable research in telecommunications. It also provides an environment for cross-disciplinary initiatives within the academic stream.

The Bahen Centre for Information and Technology supports interdisciplinary research and technology transfer in information technology. Located at the University of Toronto, the Bahen Centre is outfitted with 50 labs and almost 6.5 kilometers of fiber-optic cable and has enabled the university to double enrolment in its high-demand IT programs.

IBM Canada Centre for Advanced Studies fosters relationships among researchers, funding agencies, IBM, and customers. Examples of supported projects include data mining, grid computing for life sciences, user Interfaces for 3D environments, and e-commerce analytics.

Significant federal and provincial tax incentives in the form of R&D tax credits make the GTA an ideal location for R&D facilities. For more information, go to government support programs.

GTMA Sells French Conferencing Company on GTA Location

If you’re going to do business with the top companies in Canada, the GTA is the place to start, says Rija Raharinosy, Sales Manager for Arkadin, Inc.’s newly minted Canadian division.

Rahatinosy’s enthusiasm for Toronto is a reflection of efforts by the Greater Toronto Marketing Alliance to sell Arkadin on a GTA-based Canadian operation, and smooth out bumps in the startup process. “The GTMA worked with the Canadian Embassy in Paris to help us understand the benefits of the Toronto area,” he said. “Their knowledge and contacts were instrumental in getting us established in the GTA quickly.”

From its corporate home in Paris, France, Arkadin operates in a $5 billion global market for conferencing services. The company provides integrated, worldwide audio and data conferencing services, building worldwide sales of $45 million in just five years by emphasizing high quality, easy-to-access services supported by the most advanced communications technology.

Arkadin has operations in 17 countries in Europe, Australia, Asia and the U.S. “Canada is one of the last countries we needed to be,” Raharinosy said. “It’s a great place to start a business and be entrepreneurial.”

The GTMA worked with Arkadin to provide a sounding board for the company’s ideas and to help the firm establish relationships with GTMA partners JJ Barnicke (location assistance), Deloitte & Touche LLP (accounting) and Ian Martin Limited (staffing). These new relationships resolved many startup issues for Arkadin and helped the company shift its focus to building a market presence and customer base. “The GTMA brought their partners to the table and have been generous in their efforts to help us build a network of contacts and identify potential customers.”

Arkadin chose to locate in the Toronto area because of its diverse international focus and understanding of the value of conferencing. “Our studies show that the Toronto area is a major conference call service market, and the operational home of most of our prospective customers,” Raharinosy said. “The telecommunications infrastructure is excellent, and the area has a large, technology-literate workforce.”

Workforce issues are paramount to Arkadin, as the company’s business philosophy emphasizes hiring local service staff in each of its markets. “Delivering service with local staff helps us to be closer to our customers,” Raharinosy said. Arkadin currently has three people on staff and expects to expand to 10 to accommodate business growth in the coming months. The company is supporting its Canadian business through its U.S. operation until it is fully operational in Canada.

Arkadin continues to rely on the GTMA as it moves forward to build sales and grow its operations. “The GTMA has been very open, approachable and easy to deal with,” Raharinosy noted. “We are very confident in the future knowing they are behind us.”

GTMA Plays a Key Role in Satyam’s Canadian Expansion

When Satyam Computer Services Ltd. opened its global development centre in Mississauga, Ontario, on February 6, it was one more vital, strategic step forward for the fast growing IT consulting and services company.

“Expanding our capabilities in Canada increases our capacity to grow our North American business,” said Sanjay Tugnait, Satyam Country Manager – Canada. “It gives us an excellent opportunity to attract new clients in Canada, and enhances our ability to provide high quality, cost-effective ‘near-shore’ services to major clients in the U.S.”

The expansion was also another success story for the Greater Toronto Marketing Alliance (GTMA). The organization, whose mandate is to attract new business to the GTA, helped convince Satyam management of the benefits of locating in the GTA, and provided the company with the support, encouragement and contacts it needed to fast track the establishment of its Canadian head office in Toronto. Tugnait admits that the GTMA’s support was a significant factor in the company choosing to build its development centre close to home in Mississauga.

The new Canadian development centre is one of 10 such operations around the world for Satyam, which provides software development and other IT and consulting services to blue chip clients around the world. The company is India’s fourth largest technology services firm, and a major player in the global consulting game, with more than 90 Fortune 500 companies among its growing list of clients. While Satyam is well established in most industries, the company has an especially strong presence in the automotive, financial services, pharmaceutical and telecom industries.

Satyam’s worldwide expansion reflects the company’s focus on “right sourcing.” Satyam offers its clients the ability to source work on shore, near shore and offshore, thereby maintaining high service levels while lowering overall costs. “While sourcing work offshore provides the greatest opportunity to reduce costs, locally-based resources will deliver more hands-on service,” Tugnait said. “We want to bring our clients access to both advantages.”

The company’s right sourcing model means that while Satyam now has about 60 employees working in Canada, it employs more than 200 professionals worldwide on projects for its Canadian clients.

The availability of an educated, highly-skilled workforce was one reason that Satyam located its development centre in the GTA, Tugnait noted. “There is a strong pool of high tech talent and resources in Southern Ontario,” he said. “There are excellent engineering schools nearby, and a tremendous amount of migration of talent to the area from around the world.” The company’s ambitious plans for growth mean that Satyam’s Canadian workforce will also continue to grow, bolstering high tech employment in the GTA.

Equally important to Satyam was the comparative cost advantage of a Canadian location versus one in the U.S. A recent KPMG Canada study of international cities ranks Canada as the most attractive industrialized country in which to do business, and places the GTA ahead of all U.S. cities. Tugnait estimates that Satyam’s cost of operations in the GTA is about 20 percent lower than it would be in a comparable U.S. city.

While the quantifiable business advantages of the GTA impressed Satyam’s management, the value added resources offered by the GTMA, which helped bring Satyam to Canada, were a major factor in clinching the development centre deal.

The GTMA brought these resources to bear on Tugnait’s first visit to Toronto, setting up a full day of meetings with a number of GTMA partners – the key government, legal, financial and other facilitators who would smooth Satyam’s launch in Canada. “The GTMA brought all of the right people to the table all in one day,” Tugnait said. “It would have been very challenging to organize this myself.”

As a result of these meetings, Tugnait established ongoing business relationships with several GTMA partners, including Scotiabank, Ian Martin Ltd., Green & Spiegel LLP and the Ministry of Economic Development & Trade.

As Satyam launched its Canadian operations, the GTMA continued to pave the way. “They helped us to build and enhance our brand presence in the market by introducing us to key Canadian business decision makers,” Tugnait noted. “Clients have been very receptive to our service offering, and we’re making strong progress toward building key long term business relationships.”

On a personal level, Tugnait, who has worked in major cities around the world, is also impressed with the GTA’s multicultural environment. “People can come here from anywhere in the world and feel at home,” he said. “My family and I arrived here without a friend in Canada, and now all of our weekends are busy. We couldn’t be happier about the decision to come to the GTA.”

GTMA Helps Polaris Software Launch Global Engineering Lab

When the GTMA helped India-based Polaris Software Lab Ltd. establish a small office in Toronto three years ago, it was the beginning of an ongoing relationship that is now bearing significant fruit for both Polaris and the Greater Toronto Area.

A leading global provider of banking, insurance and financial technology solutions headquartered in Chennai, India, Polaris began a Canadian expansion in 2007 that will see its tiny downtown Toronto office blossom into a major development centre in Mississauga. The centre will provide a platform for the company’s ambitious North American expansion campaign.

“We came to Canada, and specifically the Toronto area, because of the excellent infrastructure and resources available here,” said Rahul Petkar, CEO of Polaris’ Canadian operations. “It is a cost effective jurisdiction with a skilled, well educated workforce located in the heart of Canada’s financial and high technology centre, and only a short distance from major U.S.A. clients. It is also comparatively easier to bring people from overseas to Canada for temporary work terms. Locating here was a simple decision for us.”

Petkar credits the GTMA for making the establishment and expansion of Polaris’ presence here equally easy. “The GTMA offered a one-stop shop for all of the help and resources we need,” he explained. “They put us in contact with experts in accounting, law, immigration, human resources and real estate. They also connected us with potential customers and continue to provide us with networking opportunities. Their overarching view of the marketplace, and their business development advice, are especially valuable.” As part of the relationship building process, Polaris hosted the GTMA’s first business mission to India at its Chennai head office. Installing and supporting sophisticated application modules for some of the worlds largest banks requires the ability to work closely with each customer to customize and configure solutions. Providing this capability is what drove Polaris to seek a North American presence. “Clients need their applications developed in their own time zone,” Petkar said. “Providing services close to our clients requires us to have service development and delivery centres in key markets around the world.”

The new 5,900 square foot development centre in Mississauga will be a “near shore” operation serving the North American market. It will also be Polaris’ global performance engineering lab, handling pre-installation testing and verification for its own banking products and on a contract basis for other non-banking applications. The centre will open with about 70 employees, some seconded temporarily from India and the rest hired locally. Once they are fully trained, Canadian staff will take charge of most of the work.

Petkar sees the Toronto area as a logical location for the expansion of Polaris’ business in the U.S.A. “U.S.A. customers feel very comfortable when we tell them that development work will be done in Canada,” he noted. “We have set very ambitious growth targets, and we project further expansion here as our North American sales grow.”

Top of Page

|